UAE E‑Invoicing Phases and Deadlines: What Businesses Need to Know | A Complete Guide

UAE E‑Invoicing Phases and Deadlines: What Businesses Need to Know | A Complete Guide

Share this post

Latest Post

Recent Posts

- How our ERP solution simplifies multi property management

- UAE E‑Invoicing Phases and Deadlines: What Businesses Need to Know | A Complete Guide

- Odoo Pricing Guide for the UAE 2026 | Key Factors to Consider Before Your Implementation

- Why Clean Data Drives The Highest ROI In Real Estate ERP Projects

- ERP Trends To Watch Before Stepping Into 2026: A Comprehensive Outlook

- Importance Of ERP For Growth And Compliance In Real Estate

- Why You Should Consider Odoo 19 For Your Next ERP Upgrade

- Odoo 19 Migration For Real Estate: Benefits, Risks & Migration Checklist

- How AI Agents In Odoo 19 Are Revolutionizing Business Support

- Top 7 Odoo 19 AI Features Transforming Business Workflows

What Is UAE E‑Invoicing and Why Is It Being Introduced?

E-invoicing refers to the electronic creation, exchange, validation, and storage of invoices in a structured format (not PDF or paper). The UAE’s implementation is aligned with global digital tax strategies promoting:

- Real-time VAT validation

- Increased transparency and anti-fraud measures

- Automation of compliance and reporting

- Alignment with systems like KSA’s ZATCA and EU’s Peppol

The UAE’s chosen structure is the PINT AE (Peppol International UAE) standard, an XML-based format tailored for local regulations.

UAE E‑Invoicing Rollout Timeline

The Ministry of Finance has announced a phased rollout to ensure smooth nationwide adoption:

Phase 1: Pilot (Voluntary Participation)

- Starts 1 July 2026

- Open to early adopters to test systems and integrations

Phase 2: Mandatory for Large Taxpayers

- Applies to businesses with annual revenue ≥ AED 50 million

- Must appoint an ASP by 31 July 2026

- Mandatory go-live: 1 January 2027

Phase 3: Mandatory for All Other VAT-Registered Businesses

- Revenue < AED 50 million

- Must appoint ASP by 31 March 2027

- Go-live: 1 July 2027

Phase 4: B2G Transactions (Government Entities)

- ASP appointment by 31 March 2027

- Mandatory go-live: 1 October 2027

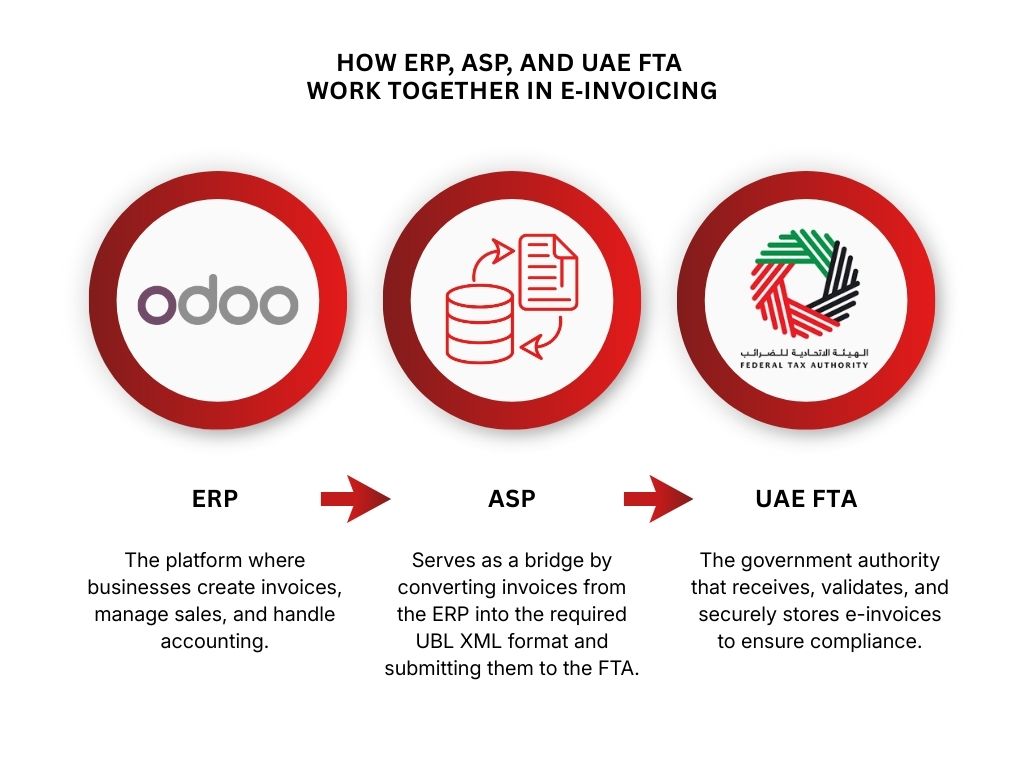

What are Accredited Service Providers (ASPs), aka The ‘Call Connectors’ of E‑Invoicing

To simplify this: think of an Accredited Service Provider (ASP) like your telecom provider for example, Etisalat or du.

When you make a phone call, your phone doesn’t connect directly to the recipient. Instead, the telecom provider validates, routes, and secures the connection.

E-invoicing follows the same principle:

- Your ERP system (like Odoo) creates the invoice.

- The ASP validates and transmits it to the UAE’s Federal Tax Authority (FTA).

- The FTA logs and accepts the transaction.

- The ASP’s job includes:

- Ensuring the invoice meets PINT AE format.

- Digitally signing and timestamping the invoice.

- Transmitting it in real time to the FTA.

- Archiving it according to UAE regulations.

Important Clarification: ERP ≠ ASP

A common misconception is that your ERP or invoicing system handles everything.

But even if you use a powerful system like Odoo, it’s not an ASP and cannot legally submit invoices to the FTA on its own.

Odoo = Invoice Creator

ASP = Invoice Validator + Transmitter

FTA = Official Receiver & Auditor

At Techbot, we help you integrate Odoo with FTA-approved ASPs, ensuring end-to-end e-invoicing compliance.

The PINT AE Format

PINT AE (Peppol International for the UAE) is the mandated e-invoice format machine-readable, highly structured, and legally binding.

It includes data like:

- Unique invoice number and timestamp

- Seller and buyer details (TRN, VAT, etc.)

- VAT breakdown

- Total values in AED

- Digital signature and ASP metadata

Paper and PDF invoices will no longer be acceptable once the mandate takes effect for your business segment.

Preparing Your Business for Compliance

Here’s how to stay ahead of the mandate:

- Review Your ERP System Ensure it can generate invoices in the PINT AE format and supports API integration with ASPs.

- Select a Certified ASP Choose an FTA-approved ASP early to allow testing, integration, and onboarding support.

- Integrate ERP + ASP Our team at Techbot ensures your Odoo ERP is integrated with your chosen ASP for real-time, compliant e-invoice flow.

- Train Finance & IT Teams Ensure everyone understands the new invoice flow, error handling, and audit trail requirements.

What Happens If You Don’t Comply?

Starting 2027, non-compliant businesses risk:

- FTA penalties for delayed onboarding

- Invoice rejections impacting payment cycles

- Loss of VAT input claims

- Exclusion from public tenders (B2G)

- Operational delays and audits

Benefits Beyond Compliance

- Faster invoice processing and payment

- Reduced manual reconciliation

- Real-time financial insights

- Stronger internal controls

- Readiness for future digital mandates

How Techbot + Odoo Empower You to Comply

As a certified Odoo Gold Partner, Techbot provides:

- Customized Odoo configurations for PINT AE invoice generation.

- Full ERP + ASP integration workflows.

- Real-time validation & error-handling tools.

- Training and onboarding support for your internal teams.

- Continuous updates as UAE regulations evolve.

Conclusion: Take Action Before the Mandate Hits

E-invoicing in the UAE isn’t a future problem it’s a present-day priority.

By preparing early, integrating with ASPs, and optimizing your ERP, you’ll not only avoid penalties you’ll drive efficiency, speed, and digital maturity across your business.

At Techbot, we’re here to help you achieve 100% compliance and unlock the value beyond it.

FAQs

Is Odoo an ASP?

No. Odoo is your ERP system. You need to connect it to an FTA-accredited ASP to submit invoices.

What is the ASP’s exact role?

Validate, digitally sign, and submit your invoices to the FTA in real time.

Can I still use PDF invoices?

No. Only PINT AE-formatted XML invoices submitted via ASP will be accepted once the mandate starts.

When does the UAE e-invoicing mandate become mandatory?

- 1 January 2027 for large businesses (annual revenue ≥ AED 50 million)

- 1 July 2027 for others

- 1 October 2027 for B2G transactions (businesses dealing with government entities)

How can Techbot help?

We integrate your Odoo ERP with certified ASPs, configure PINT AE invoicing, train your teams, and ensure full compliance.

Why is e-invoicing mandatory in the UAE?

The FTA mandates UAE electronic invoicing to improve transparency, reduce tax errors, and ensure accurate VAT reporting across all registered businesses.

Who sets the e-invoicing requirements in the UAE?

The Federal Tax Authority (FTA) defines all UAE e-invoicing requirements, including invoice format, submission process, and compliance timelines.

How does UAE e-invoicing affect VAT compliance?

With UAE electronic invoicing, all invoices are digitally tracked by the FTA, making VAT reporting and compliance more accurate and easier to audit.

Can e-invoicing in the UAE be done without an ASP?

No. All UAE e-invoicing requirements mandate that invoices be submitted via an FTA-accredited ASP in the correct PINT AE XML format.

As defined by the Federal Tax Authority for UAE electronic invoicing and VAT compliance.

Transform the way you manage projects, sales, and finance with Odoo ERP designed for UAE real estate management.

Get the latest tips and updates on ERP software solutions. Subscribe to our newsletter and stay ahead in business!

Latest Post

Recent Posts

- How our ERP solution simplifies multi property management

- UAE E‑Invoicing Phases and Deadlines: What Businesses Need to Know | A Complete Guide

- Odoo Pricing Guide for the UAE 2026 | Key Factors to Consider Before Your Implementation

- Why Clean Data Drives The Highest ROI In Real Estate ERP Projects

- ERP Trends To Watch Before Stepping Into 2026: A Comprehensive Outlook

- Importance Of ERP For Growth And Compliance In Real Estate

- Why You Should Consider Odoo 19 For Your Next ERP Upgrade

- Odoo 19 Migration For Real Estate: Benefits, Risks & Migration Checklist

- How AI Agents In Odoo 19 Are Revolutionizing Business Support

- Top 7 Odoo 19 AI Features Transforming Business Workflows